With the burden of account receivables and mismanaged inventory, the liabilities and bad debts become excessive.

Here the company is probably handling too many account receivables, that is the due amount to be paid by a client or customer. That is the company is inefficient at producing revenue. That is the company generates a high revenue price for each dollar of working capital spent.Ī low turnover ratio in turn implies that the return on working capital expenditure is low.

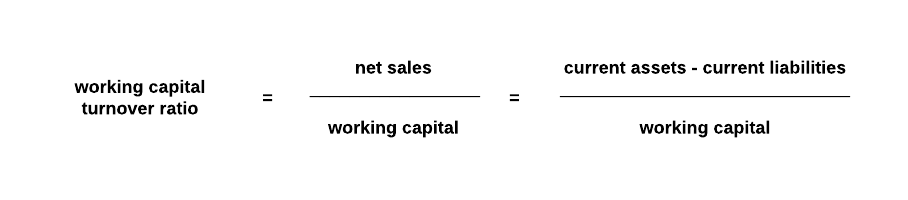

But what does a high or low working capital ratio imply from a financial standpoint?Ī high turnover ratio implies that a company is being extremely efficient in using its working capital (short-term assets and liabilities) to support its efforts to generate more sales. If the ratio is too high or too low than the industry’s average ratio, they should look for outliers in the company’s financials to make informed decisions.Implications of Working Capital Turnover RatioĪ company’s Working Capital Turnover Ratio tells a lot about the company’s ability to generate results for the value spent. The analysts and the Company’s management often look at this ratio while doing business analysis. The (WCTR) gives an indication of efficiency in the utilization of the working capital. The (WCTR) is a significant indicator of the efficiency of the Company and how well it is doing compared to its competitors. High account receivables have credit risk, and higher inventory has a risk of going stale, which is not good for sales. A lower ratio may indicate Company has higher account receivables or inventory assets.However, a very high ratio of ~80% may indicate that the Company does not have enough funds to support the growth in its sales, further indicating the prospects of the Company being insolvent in the near future due to higher account payables.A higher ratio demonstrates the company’s efficiency and gives it a competitive edge over rivals.The ratio provides a gauge for the efficiency with which the business is run and its financial management is carried out.It helps the company to understand the relationship between working capital investment and revenue generation.WCTR measures the revenue of the Company from the working capital funds available with it.The management can decide on business expansion if it feels they have enough funds to continue its operations and build new resources.The ratio helps the management to make an informed decision on raising funds and utilization of the Company’s resources.The ratio gives an indication of the operations of the Company.WCTR= Net Revenue from Operation (Sales) ÷ Average Working Capital WCTR is calculated using the formula given below The average Working Capital of Apple Inc.is calculated using the formula given below.Īverage Working Capital = (Beginning Working Capital + Ending Working Capital) / 2 Beginning Working Capital = $131,339 – $116,866Įnding Working Capital (2017) is calculated asĮnding Working Capital = Total Current Assets − Total Current Liabilities.

#OPERATING WORKING CAPITAL TURNOVER HOW TO#

How to Solution in Working Capital Turnover Ratio (Step-by-Step)īeginning Working Capital (2018) is calculated asīeginning Working Capital = Total Current Assets − Total Current Liabilities

0 kommentar(er)

0 kommentar(er)